Retire smarter. Pay less in taxes.

The Retirement Tax Revolution

Retirement isn’t just about what you’ve saved—it’s about how much you get to keep. This practical, story-driven book helps you navigate the often-overlooked world of retirement tax strategy planning, to help you make smarter decisions and potentially minimize what you owe.

Whether you’re approaching retirement or already there, this book offers clear explanations, real-life examples, and actionable strategies to help you take control.

Get Your No-Cost Book + A Personalized Retirement Freedom Blueprint

We'll help you minimize taxes in retirement

Many retirees overpay in taxes. Our goal is to help you avoid that.

Schedule a meeting and you'll get:

A No-Cost copy of The Retirement Tax Revolution

A No-Cost, No-Obligation Retirement Tax Strategy Session

Your Custom Retirement Freedom Blueprint

This meeting will be held over Zoom. Please ensure your time zone is accurately reflected on the calendar.

Just want the book?

Order it on Amazon and have it delivered to your door.

Here’s What You’ll Discover Inside the Book:

How to potentially lower your lifetime tax bill with smart withdrawal timing.

Tips on the right order to tap your IRA, Roth, HSA, and brokerage—to help ensure you don't leave money on the table.

A simple framework to help you coordinate your investments, taxes, and Social Security into one efficient plan.

When a Roth conversion may make sense—and how to avoid some common traps.

How to potentially turn capital gains and losses into a long-term tax advantage.

Who Should Read This Book?

If any of these sound like you, you should get your copy as soon as possible:

You’ve saved $500,000 or more and want to protect it from taxes.

You’re ages 55 to 70 and planning to retire—or already retired.

You want clear, time-tested strategies (not financial fluff).

You’re curious about Roth conversions but unsure if they’re worth it.

You’d like to stop guessing and start planning with confidence.

Many retirees overpay in taxes

Not because they did anything wrong—but often because they didn't know how to plan properly. Our goal is to change that.

Use the calendar

to schedule your

No-Cost Taxes & Retirement Strategy Session

and receive your no-cost copy of

The Retirement Tax Revolution and your personalized

Retirement Freedom Blueprint.

Reduce Your Tax Bill

Clear, time-tested strategies designed to help minimize what you owe

Stretch Your Savings

Ways to help make your retirement funds last longer with smart planning

Avoid IRS Surprises

Stay ahead of tax traps whether planning or already retired.

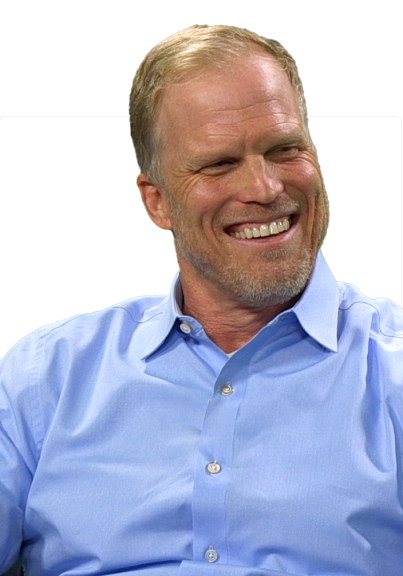

Erik Bowman, RICP®, NSSA®, CTS™

Wealth Advisor, Owner

About The Author

After helping hundreds of families prepare for retirement, I’ve seen one mistake cost many of them more than any market downturn: overlooking taxes.

That’s why I wrote The Retirement Tax Revolution—to reveal how smart timing and strategy can help you keep more of what you’ve earned. Inside, you’ll find simple, actionable ways to help you reduce lifetime taxes, avoid common withdrawal mistakes, and make your money last longer—no matter where you are in your retirement journey.

Resources to help with your Retirement Planning.